King County Treasury Reduces Taxpayer Late Fees By 62% With GLSS

Home » Case Study » King County Treasury Reduces Taxpayer Late Fees By 62% With GLSS

Ana Schoenecker has worked for the King County Treasury for 14 years. She is the current Real Property Administrator for the Property Tax Office and she is a Lean Six Sigma Green Belt. Laura Wilson has worked for King County for almost 12 years and in Treasury for 6 years. She is a Fiscal Specialist in the Property Tax Office and she is also a Lean Six Sigma Green Belt.

After receiving many calls from angry taxpayers who were forced to pay extra interest and penalties on their mortgages, Ana and Laura knew that their mail blow backs were responsible.

THE CHALLENGE

Mail blow backs are any returned mail that was unable to be delivered. In this case, payment deadlines were being mailed but due to outdated information in their system, many taxpayers weren’t receiving these notices. When this mail is not received, taxpayers end up paying later and larger delinquency fees – resulting in lower customer satisfaction with the county.

THE DISCOVERY

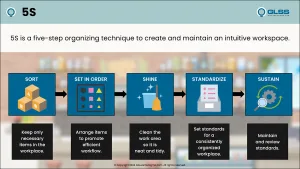

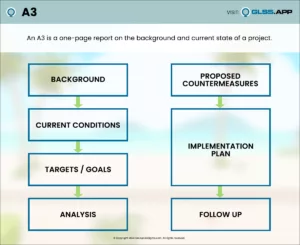

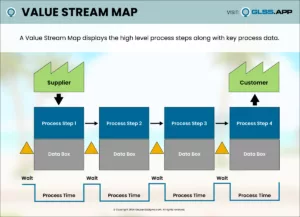

Ana and Laura started their project by gathering the Voice of the Customer to better understand their customer requirements. They then created a SIPOC to understand the scope of their project and used an “As-Is” Process Map to understand the full process end-to-end.

After mapping their process, they formed a Data Collection Plan, collected sample baseline data from 2016, and found that taxpayers who did not receive their notice letter paid an average of $409 in late fees! Taxpayers who were not able to be notified for years were even approaching foreclosure. Not good!

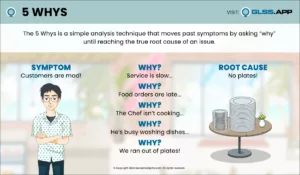

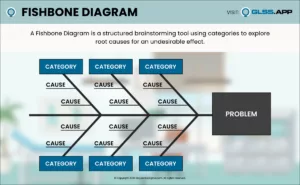

So Ana and Laura decided to create a Fishbone Diagram to identify potential root causes for this issue and verified their Root Causes to vet the suspected problem-causers. One discovery was that there was no follow-up process to ensure that returned mail would eventually reach taxpayers and this needed to change.

THE IMPROVEMENTS

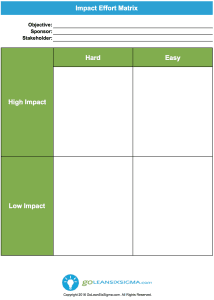

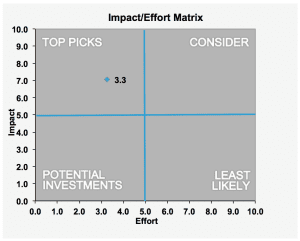

Ana and Laura completed a Solution Selection Matrix and were able to identify the best solution for their problem. They decided to add steps to their process to follow up on this returned mail in order to better provide taxpayers with the ability to avoid increased interest payments and penalty fees.

The steps they added were:

- Revenue Collections would forward the returned mail to Treasury

- Treasury Customer Service would research returned notices, update address information in their system, reissue the notices, and track them to ensure they are delivered

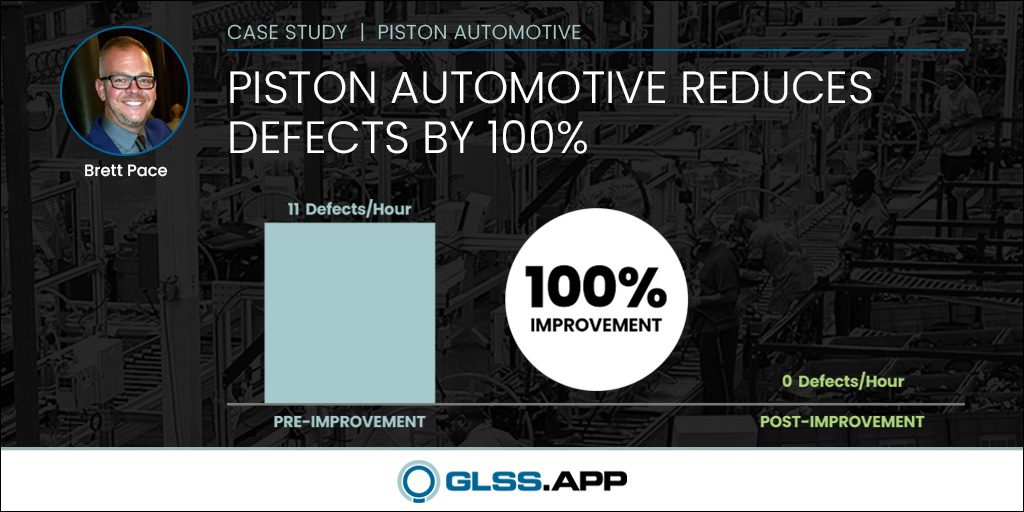

After implementing these two steps into their process, they saw an enormous benefit to their taxpayers:

- In 2018, taxpayers paid an average of $253 less in interest and penalties than in 2016

- In 2018, Taxpayers paid an average of 2.5 months faster than they did in 2016

The Treasury team is now receiving fewer angry phone calls from taxpayers and mail blow backs and less taxpayers are going into foreclosure.

Ana and Laura are proud to know that their taxpayers are better taken care of and are happier with the county. They were also able to motivate their team members through their process improvement project and build deeper trust among their team.

Great job, Ana and Laura!