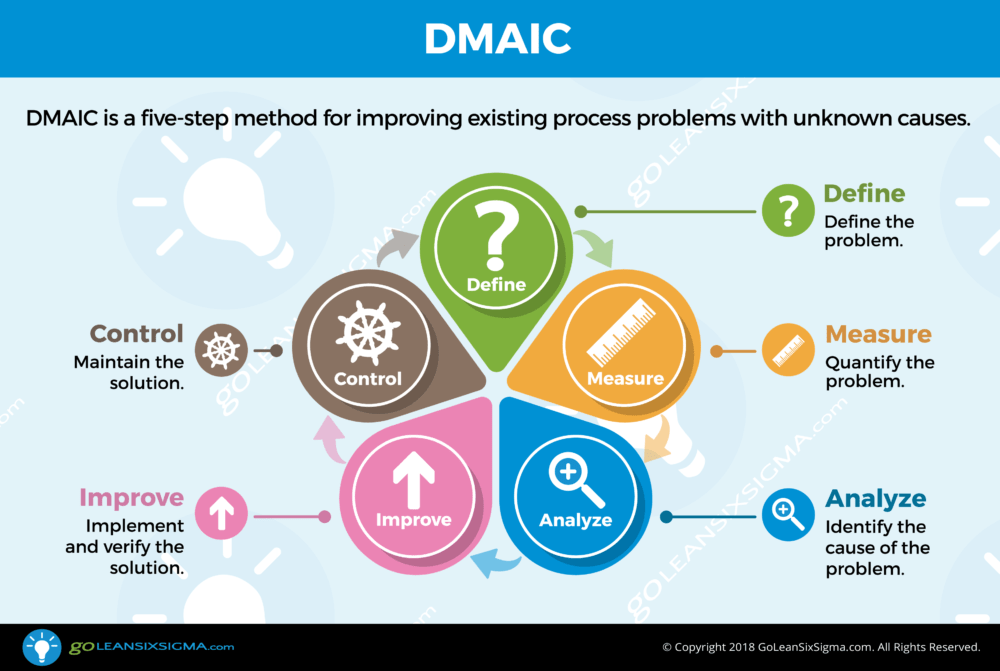

Companies are well versed on the benefits of Lean Six Sigma — a common-sense approach to fixing problems. Thousands of organizations use it to define problems, quantify them, identify the causes, implement fixes and maintain the solutions. That approach has been successfully adopted by businesses around the globe for decades.

Did you know it can be applied to personal finances too? This same approach provides clear and practical ways to get out of debt, save more for retirement and sock away money for short-term goals.

How You Can Apply Lean Six Sigma to Personal Finance

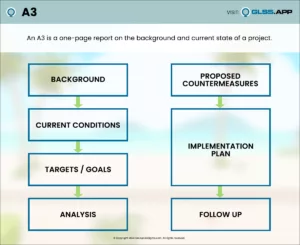

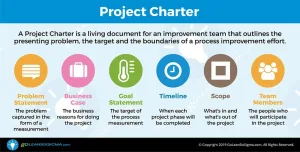

DMAIC, or Define, Measure, Analyze, Improve and Control is the five-step problem-solving model that can be applied to any process. We’ll use it to breakdown some common personal finance problems and see how the model works.

Define Your Personal Finance Problem

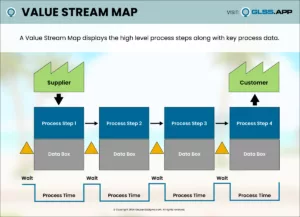

We’ll start by defining the problem. You might be surprised at how often people charge up a storm, live above their means or drown in debt without realizing they have a personal-finance problem — or worse, they just ignore it. They go about their days, weeks, and months paying the minimum on their credit cards, incurring debt and having little if any money saved for emergencies, let alone retirement. That can create untold financial hardships and a potentially lifelong cycle of debt. Using the DMAIC problem-solving structure of Lean Six Sigma is a way out.

One of the first steps in DMAIC is to define the problem. For people who are in debt, admitting there is a problem is the only way they to correct it. To do that, they have to conduct a deep dive into the intricacies of their debt and compare that to their income, with an eye toward identifying ways to cut expenses.

People who are in debt have to conduct a deep dive into the intricacies of their debt and compare that to their income, with an eye toward identifying ways to cut expenses.

Without looking at credit card statements, the interest rates on the balances, and their purchasing habits, they won’t be able to define the problem. Sometimes a cold, hard reality check and a deeper understanding of your debt is all you need. But most of the time it requires successfully identifying the problem.

But getting out of debt isn’t the only personal finance problem to tackle using Lean Six Sigma. For people nearing retirement or trying to set aside money for an emergency, identifying what is preventing them from making that happen can be the starting point for change.

Consider retirement savings. Everyone knows they’re going to need a lot of money to live out their golden years in the style they’ve grown accustomed to, but many Americans do a really bad job of saving for their undeniable future. The question is, why? The answer typically lies in how people set their priorities. Recognizing you face a shortfall, and that it will be a huge problem come retirement time, is the first step toward finding a solution.

Measure the Size of the Problem

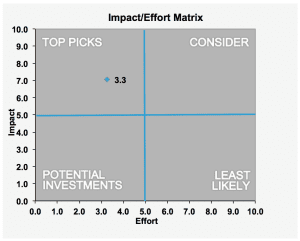

Credit card debt can be crippling, as can a retirement shortfall. What is tolerable to one person might be intolerable to another. Either way, when applying DMAIC to your personal finances you have to quantify the problem. For debt holders, that means determining the total amount you owe. For those facing a retirement shortfall, you’ll have to figure out how much you’ll need to live on once you stop working — factoring in any unexpected medical expenses and inflation over the coming years. Armed with that information, you can compare what you need with what you have saved to quantify your problem. Establishing the gap between your baseline budget and target budget helps guide your efforts.

Establishing the gap between your baseline budget and target budget helps guide your efforts.

This strategy can also be applied to saving for a down payment on a new home or a reserve fund to send your children to college. You have to be able to quantify how much you require before you come up with a plan to meet your financial goals or fix a personal finance problem.

Analyze & Identify the Cause of the Problem

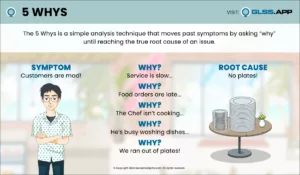

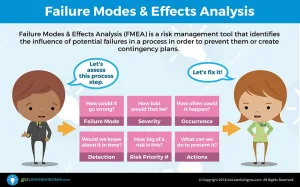

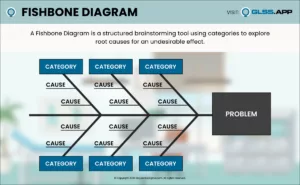

In order to change a behavior, you have to figure out why it’s happening in the first place. It’s a tenet of Lean Six Sigma and should be yours too. If credit card debt is the problem, figure out what got you there. Sometimes people shop to fill a void —because they’re sad or depressed, or maybe they want to keep up with the lifestyles of their neighbors, friends or co-workers. Those are all bad reasons to spend money.

The good news is you can control these habits. If you identify the triggers for your out-of-control spending, you can come up with strategies to reign it in. Let’s say it’s the need to keep up with the Joneses that is at the heart of all of your credit-card debt. One solution is to stay away from the people who make you feel inferior or tell yourself that having a $700 pair of shoes isn’t going to make you feel better about yourself.

If your issue is a retirement shortfall, take a look at what you’ve been doing with the money instead. If student loans preclude you from saving for retirement, and you know that, you can plan to reduce outlays elsewhere so you can put money away for retirement. If you’ve ignored the company retirement plan because that future seems many years away, you can change that too. The trick is to recognize why you aren’t saving.

Identifying the problem, determining its size and the why behind its existence goes a long way toward helping you come up with a solution you’ll be able to stick with for the long-term.

Identifying the problem, determining its size and the why behind its existence goes a long way toward helping you come up with a solution you’ll be able to stick with for the long-term.

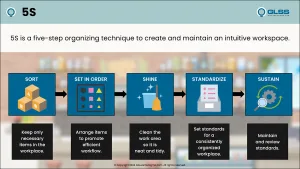

Improve Your Financial Process and Check On it Periodically

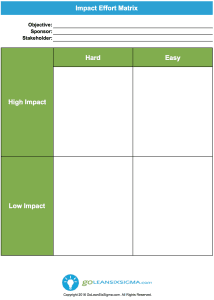

Armed with the size and reasons for the problem, you are ready to apply one of the last two phases of DMAIC: devising a solution to improve the process. It’s not enough to say, “I’m going to stop using my credit card” and leave it at that. You need a feasible plan. This can mean destroying credit cards, closing accounts or vowing to keep them in a safe and pay with cash only. You also need to regularly revisit whatever solution you use to make sure it is still realistic and working. If it’s not, tweak it until it is. The idea is to devise a solution and make sure it is enough to fix your problem and achieve your goals.

It’s not enough to say, “I’m going to stop using my credit card” and leave it at that. You need a feasible plan.

Let’s go back to the retirement savings example. In order to effectively apply DMAIC, you have to come up with a plan to start saving for your golden years. That may mean participating in a company-sponsored retirement savings plan or opening up an IRA. Cash-strapped? Thanks to the financial technology movement, there are a host of startups that let you save your spare change and invest that in stocks, mutual funds and exchange-traded funds.

Stick to Your Solution — Keep It Under Control

In order to successfully apply the principles of Lean Six Sigma, you have to stick to your plan long enough to see it make a difference. Even the best laid-out strategy will fall to the wayside if there isn’t commitment on your part. The way to keep your new plan in control is to regularly check your balances, debt, reserve funds and the other measures of your financial health. Hold yourself accountable. It’s ok to have some missteps along the way, but the more you follow your strategy the closer you will be to fixing the personal finance problem.

Even the best laid-out strategy will fall to the wayside if there isn’t commitment on your part.

Final Thoughts

Lean Six Sigma and the DMAIC method may seem like a complicated process used only by businesses, but the principles involved are simple and can be applied to different aspects of your life. That’s why using it to solve a personal-finance problem makes perfect sense. After all, Lean Six Sigma helps you do a deep dive into the current state of your finances and devise a realistic strategy to bring positive financial results.