Premier America Elevates Customer Service By 24% With GLSS

Home » Case Study » Premier America Elevates Customer Service By 24% With GLSS

California

Finance

Customer Service

24%

PROJECT SUMMARY

- Business Case: Optimize our member service experience and increase our NPS score

- Root Cause Analysis:

- TMs being expected to call to meet the 24hr SLA for hard-declined applications

- The contact center’s belief that 14 days of follow-ups would be the most effective

- Deficiency in the tools we have (can’t properly evaluate the legitimacy of IDs, address verification, phone number verification (area code doesn’t match where the applicant applied via IP address)

- Tools lacking features (require the capability to confirm if an individual lives at the claimed address)

- Solutions Implemented:

- Send adverse action emails for hard declined applications

- Decrease the number of follow-up days from 14 to 10

- Require applicants to come into the branch when their submitted documentation is questionable

- Decrease the 14-day application follow-up rule to 10 days

- Automate emails to the applicant if a response to a follow-up attempt is not received after 10 days

- Create a detailed script for callback attempts

- Collaborate with Gro to escalate the limitations being experienced when it comes to fraudulent applications

- Ask FIU which tools they would recommend that we incorporate into our budget for next year

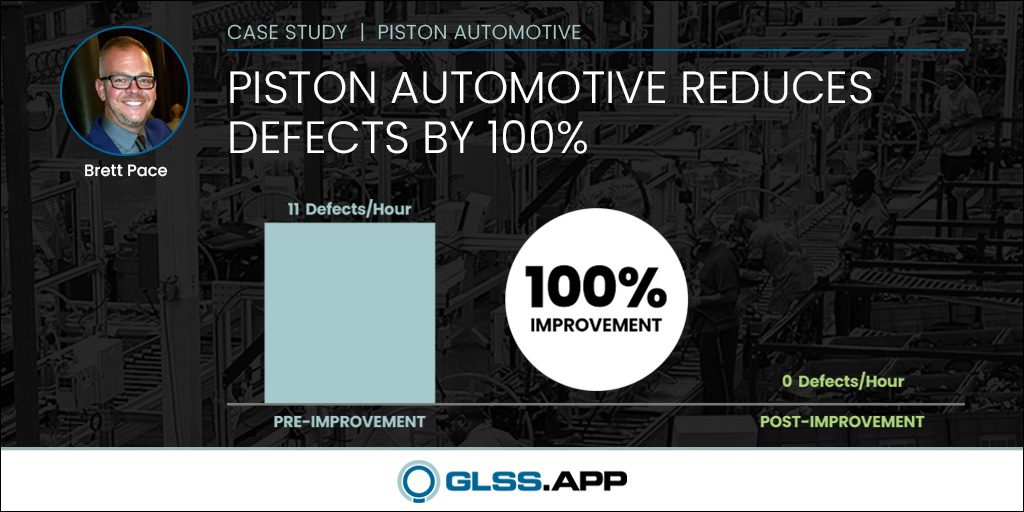

- Project Result: SLA % Completion Rate increased 75%to 99.12%

In the dynamic realm of banking where customer satisfaction reigns supreme, Credit Unions like Premier America distinguish themselves by considering their customers not just as clients but as valued members and co-owners. The heartbeat of Premier America’s commitment is encapsulated in its purpose: “Making it easier to meet today’s needs and reach tomorrow’s dream.”

A pivotal aspect fueling member satisfaction and the revered Net Promoter Score (NPS) was Premier America’s member support for online account openings. However, a significant challenge loomed: their 24-hour call-back Service Level Agreement (SLA) was met only 75% of the time, falling short of their ambitious 100% target.

Will Robinson, armed with the power of GLSS Green Belt Training embarked on a mission to turn the tide with GLSS’s innovative instructional design, user-friendly interface, and, above all, track record of delivering results.

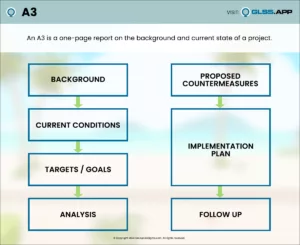

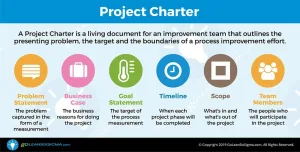

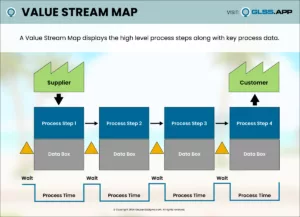

Will’s journey began by crafting a Charter, delineating the project’s scope, and utilizing LSS methodologies such as Process Mapping and Data Collection to understand the existing situation. Swiftly, it became evident that inconsistencies within the process resulted in call completion rates languishing below 75%. A Process Walk revealed manual processing bottlenecks, prompting multiple follow-up calls for additional information. These early insights paved the way for potential improvements.

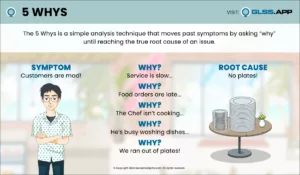

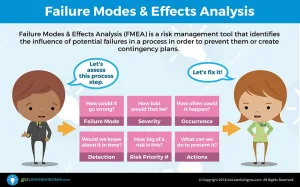

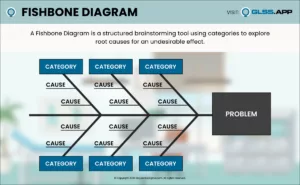

Under the guidance of GLSS training, Will led the Contact Center team in unraveling the complexities of the process. The training’s knack for simplifying intricate processes made it a breeze for Will to delve deeper into the true causes of the problem. Utilizing the Fishbone and 5 Whys tools, Will pinpointed the root causes:

- Countless follow-up calls to fund accounts

- Team Members compelled to call for 24-hour SLA on hard declined applications

- Call Center advocating a 14-day follow-up for optimal effectiveness

- Tools lacking the capability to evaluate ID information and verify claimed addresses

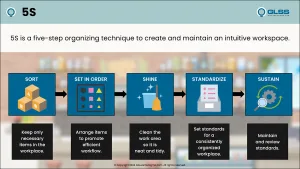

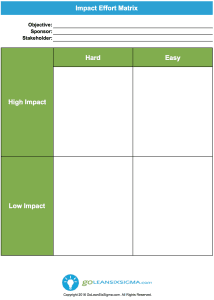

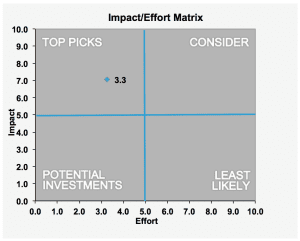

Empowered by insights gained from the GLSS step-by-step root cause analysis, the team focused on developing the best solutions—those that would provide the most impact quickly with the least amount of time and money. Guided by the Solution Selection Matrix, the team implemented the following solutions:

- Implement adverse action emails for hard declined applications

- Trim follow-up days from 14 to 10

- Mandate branch visits for questionable applications

- Automate emails to applicants for non-responsive follow-ups

- Develop a detailed script for callback attempts

- Collaborate with software providers to enhance fraud detection

- Seek recommendations from the Financial Intelligence Unit (FIU) for future budgetary inclusions

The callback completion rate soared to an impressive 99.12%. The team achieved near-perfection swiftly and efficiently, without the need for costly software purchases and automation.

Premier America’s journey exemplifies the tangible benefits of applying GLSS Lean Six Sigma training to intricate financial operations. GLSS’s instructional design and user-friendly approach played a pivotal role in fostering quick problem-solving, culminating in a remarkable enhancement of Member Satisfaction.

This case study stands as a testament to the transformative power of GLSS Lean Six Sigma training in elevating member service excellence in the complex landscape of finance.