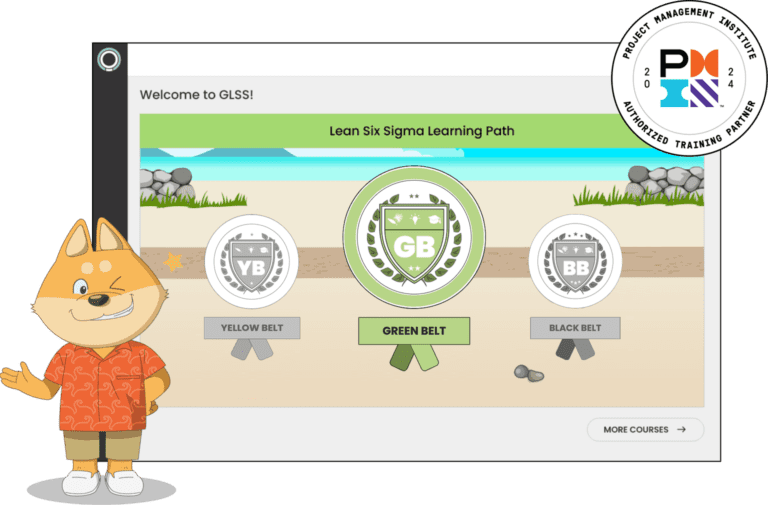

The best Lean Six Sigma Process Improvement Problem-solving Project Management training for teams

Start your Green Belt Training for free.

Accredited by PMI. Over 15,000 glowing reviews.

Per Project*

in Downtime

Processing Time

Reduction

in Production

EMPOWER EVERYONE'S EFFICIENCY WITH GLSS

Define

Define

Clarify the problem and process

Measure

Measure

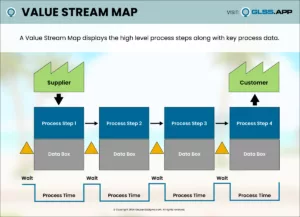

Quantify the problem and map the process

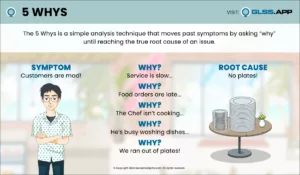

Analyze

Analyze

Determine the root causes

Improve

Improve

Confirm the solutions work

Control

Control

Ensure the gains are sustained

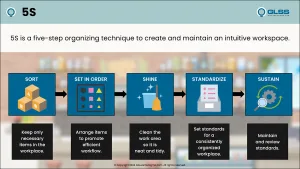

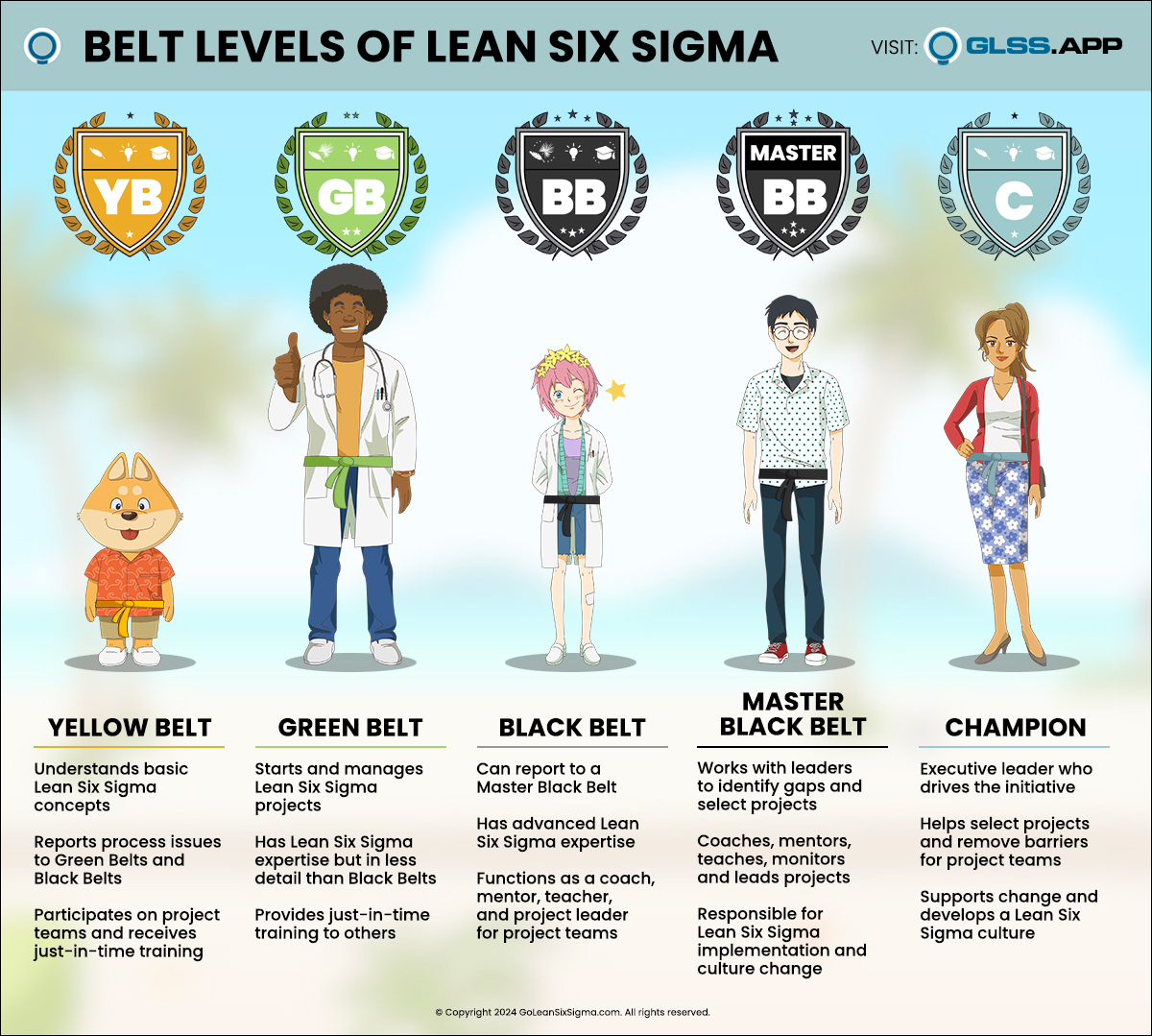

WHAT IS LEAN SIX SIGMA?

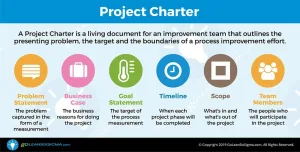

Lean Six Sigma is a problem-solving method that has 5 phases: Define, Measure, Analyze, Improve and Control.

Don’t spend hundreds of hours and tens of thousands of dollars on outdated Lean Six Sigma training that frustrates you and your teams.

GLSS makes Lean Six Sigma easy to understand—so you and your teams can begin improving processes in a few days for a fraction of the cost of outdated approaches to Lean Six Sigma.

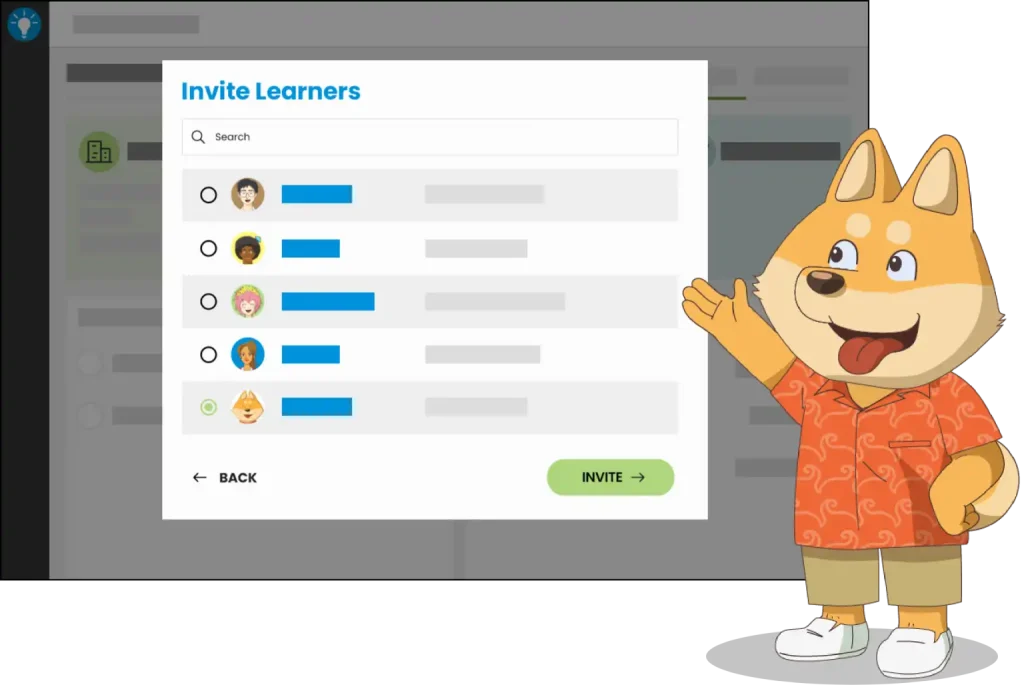

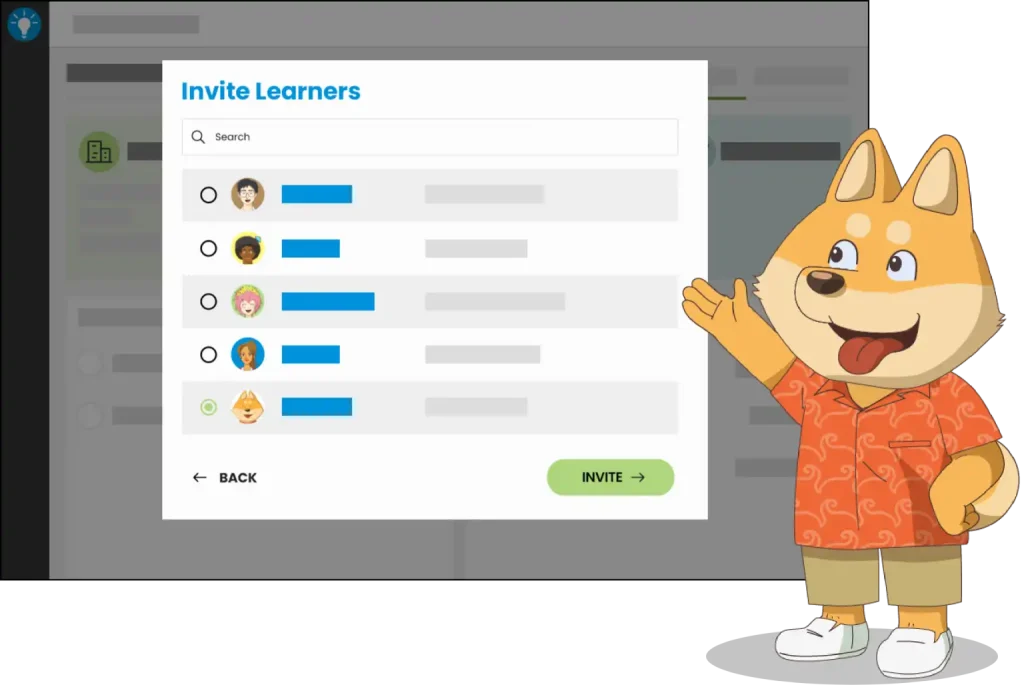

TRAIN BETTER TOGETHER

Easily and affordably set up your teams with our Learning Management System—then track training progress across your organization.

Train your teams for as low as $19/person with our Enterprise Plan.

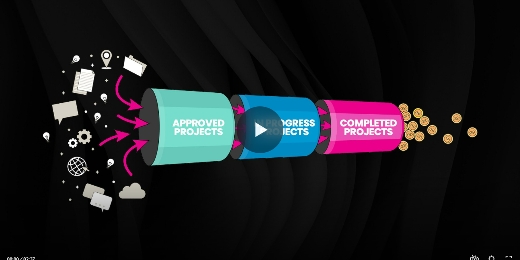

PROJECT-BASED LEARNING

With GLSS, you and your teams can deliver real results and ROI.

Our optimized approach helps you and your teams complete real projects and deliver real business results alongside training—and get support from our Master Black Belts if you need it.

On average, our clients get 14X ROI from their partnership with us. Plus, we help you build sustainable internal capability so you don’t need expensive external resources.

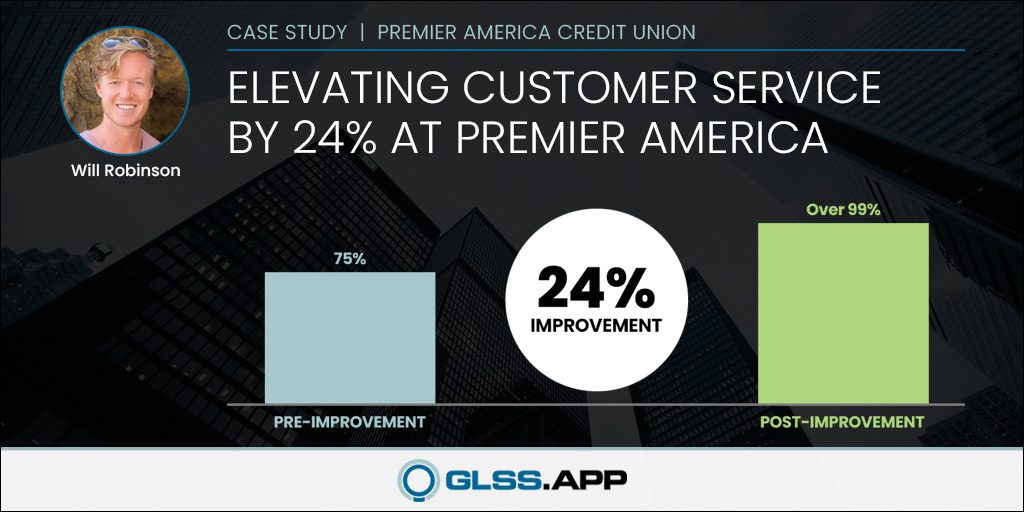

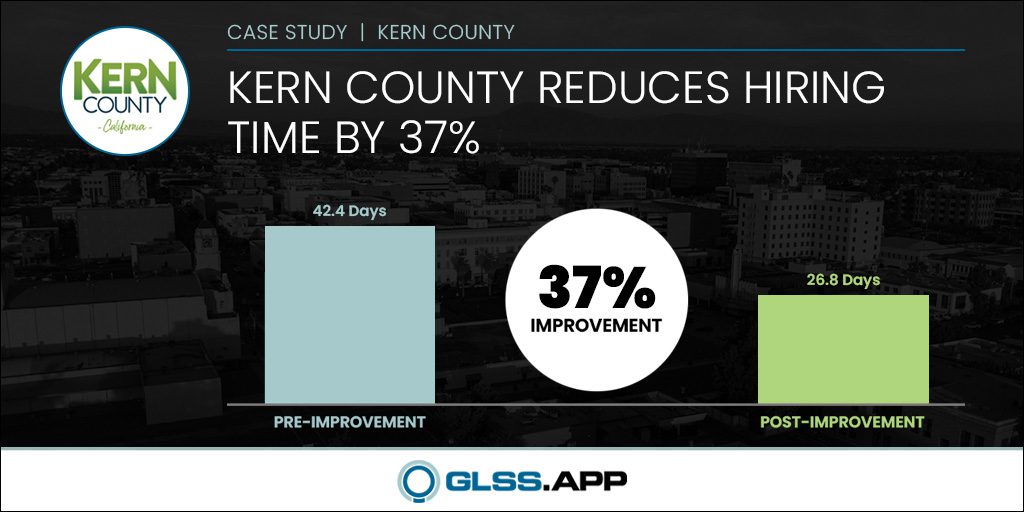

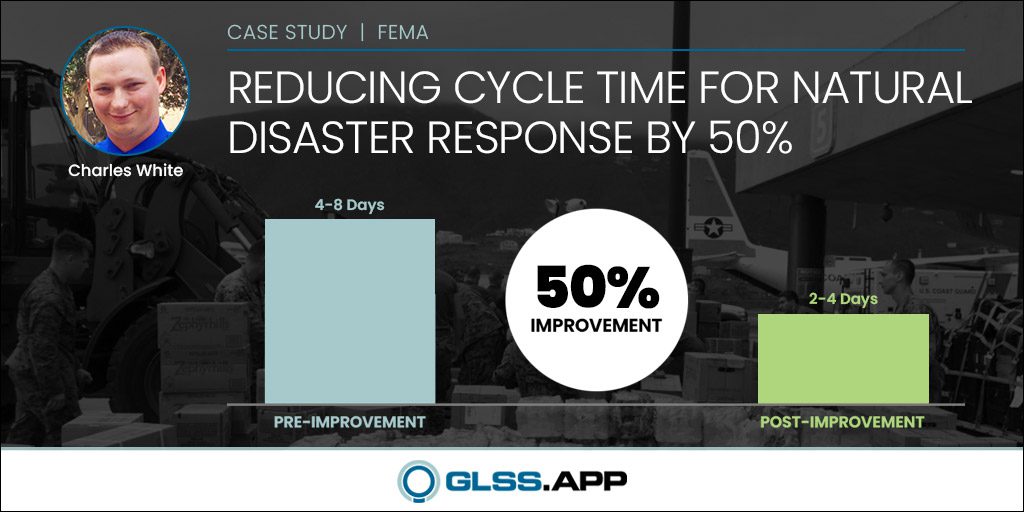

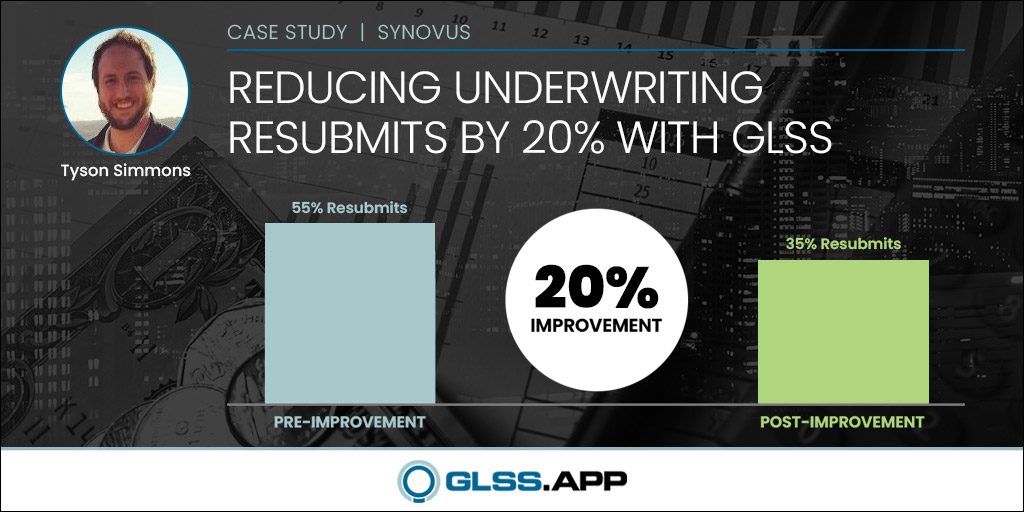

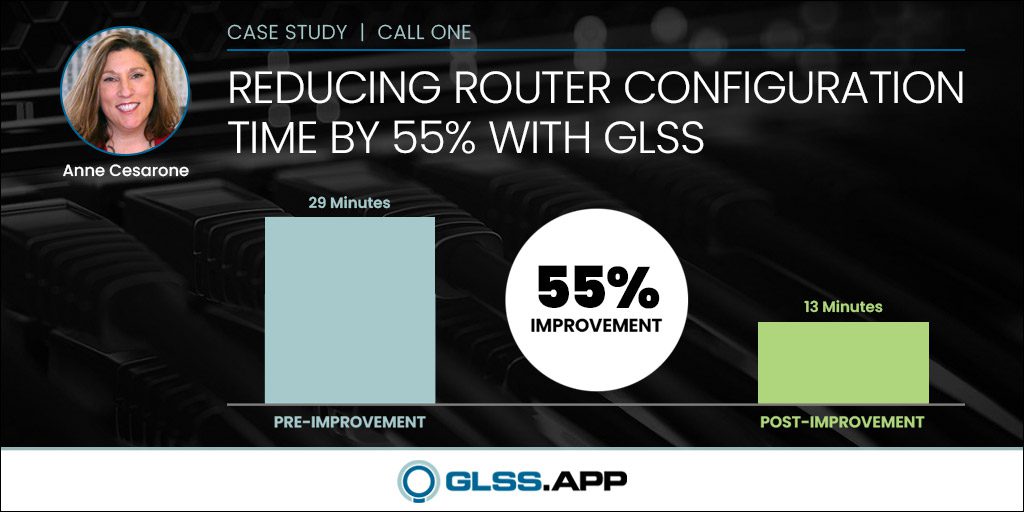

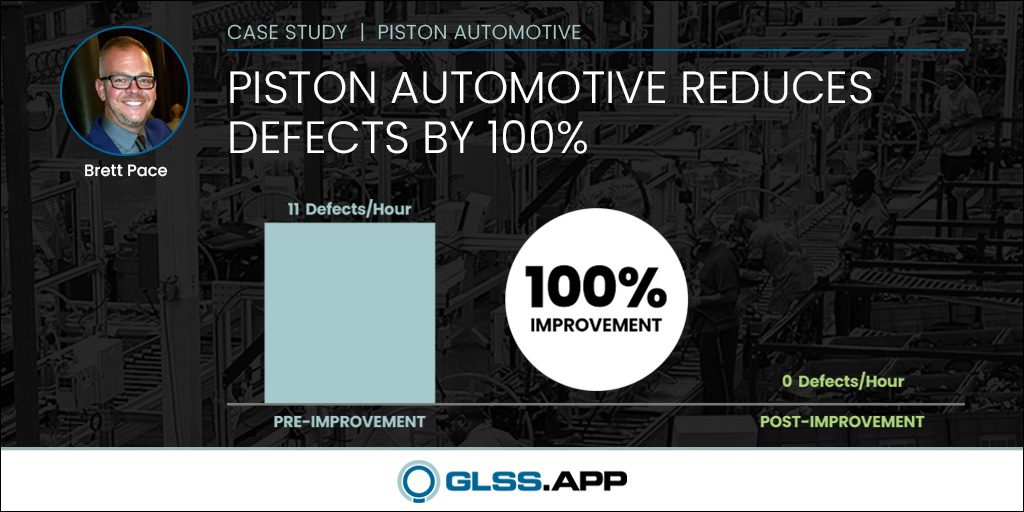

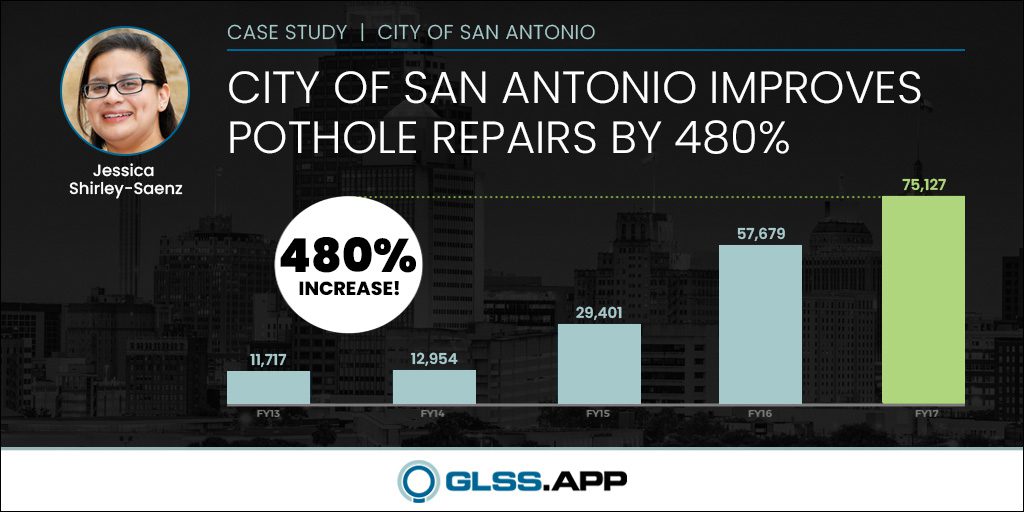

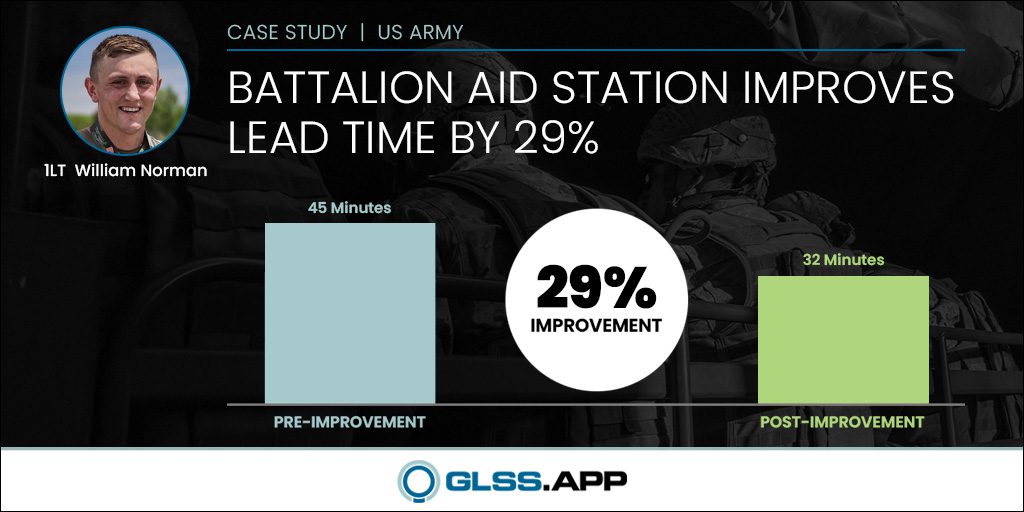

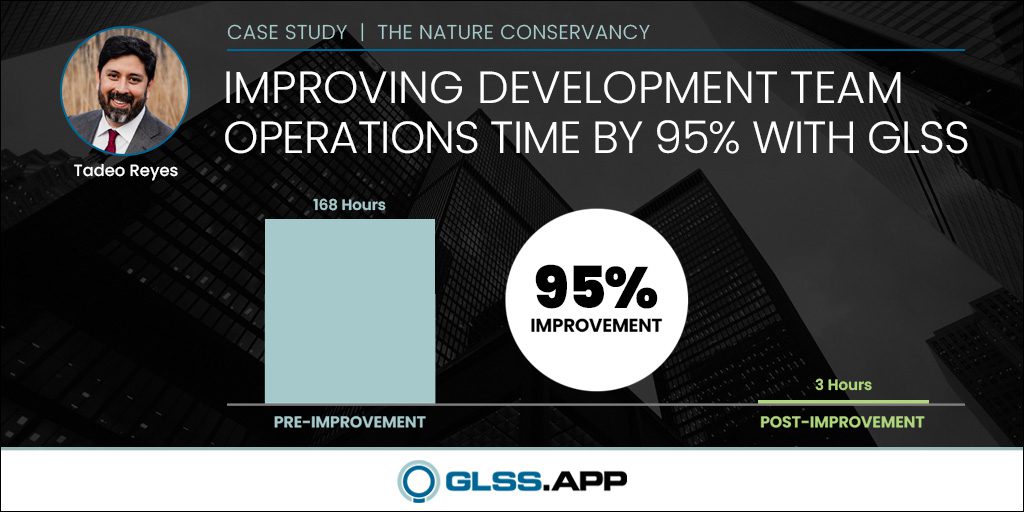

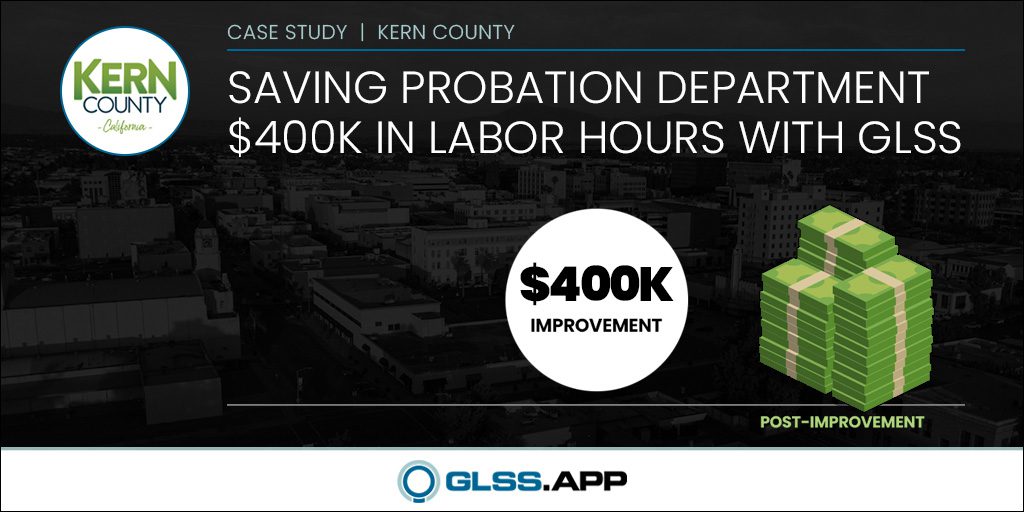

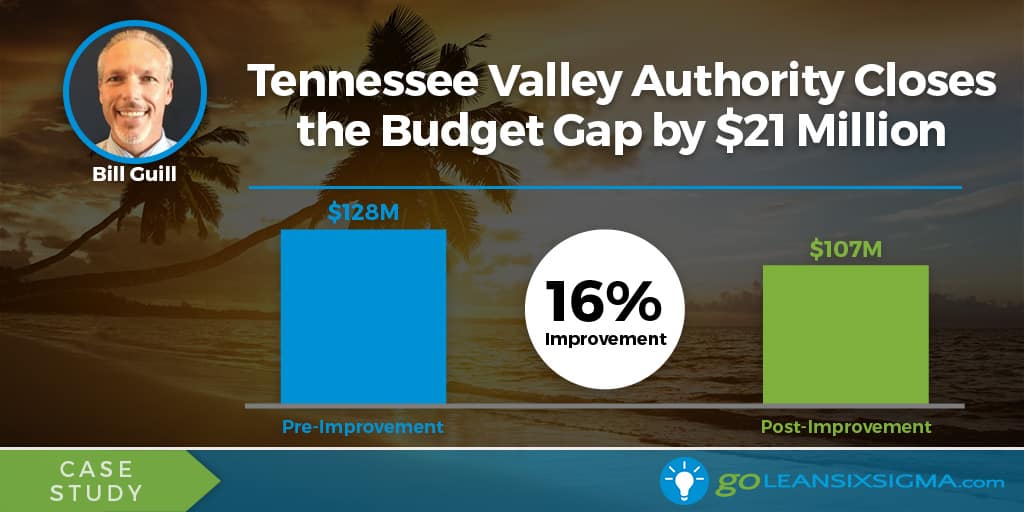

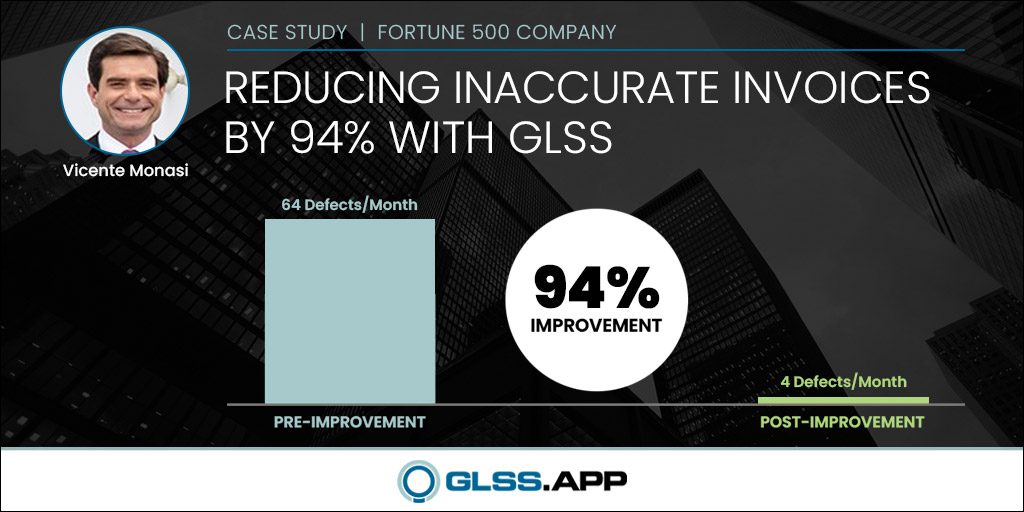

Lean Six Sigma Case Studies

CLIENT REVIEWS

"I had my entire team gain their Lean Six Sigma Green Belt through them and the content made sense to everyone – from those with little to no experience with Six Sigma and to those who were experienced."

"GoLeanSixSigma.com’s courses have put our teams on the right continuous improvement path. I had a lot of fun working on my project and their templates made the process so much easier and enjoyable."

"GoLeanSixSigma.com does a great job explaining Lean in an easy to follow format – and that’s not an easy task. It’s what got me interested in their courses. The customer service they provide have exceeded my expectations."

LEARNER REVIEWS

"Great course. I believe anyone, at any level of any organization, can benefit from the principles taught at GLSS. This approach to process improvement is explained in simple and practical terms, showing how everyone is affected by and can contribute to the overall success of their workplace."

"GLSS makes learning and implementing Lean Six Sigma concepts accessible. The content and exams are structured in a way that allows flexibility. It's detailed without containing a lot of superfluous information, and the resources provided by GLSS are plentiful. After looking at many online learning and certification resources, GLSS is the best."

"This was an excellent course. Very challenging and thorough. I have done other courses that no where near prepare you for the challenges and practical practice of Lean Six Sigma. This course was on par with my MBA studies. I highly recommend it!"

Read more

Read more